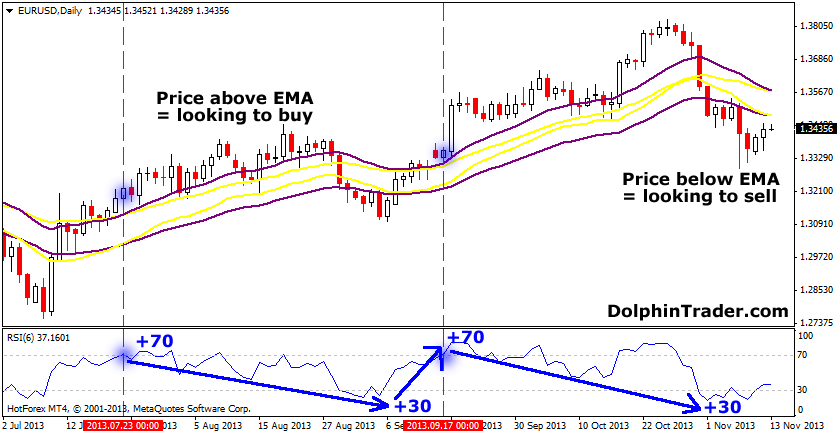

Rsi forex chart

Although it may sound counter-intuitive, typical use of Forex indicators can actually cause an inexperienced trader to lose money, rather than make money. However, if you are going to use one, the best Forex indicator is the RSI Relative Strength Indicator because it reflects momentum, and it is well established that following Forex momentum can give you a winning edge.

The RSI is a Forex momentum indicator , and it is the best momentum indicator. If you are going to use the RSI, the best way to use it is to trade long when it is showing above 50 on all time frames, or short if below 50 on all time frames.

It is best to always trade with then trend of the last 10 weeks or so.

The Relative Strength Index formula was developed in the s, like so many other technical analysis concepts. The Relative Strength Index calculation is made by calculating the ratio of upward changes per unit of time to downward changes per unit of time over the look-back period.

The actual indicator calculation is more complex than we need to worry about here. What is important to understand is that if the look back period for example is 10 units of time and every single one of those 10 candles closed up, the RSI will show a number very close to If every single one of those 10 candles closed down, the number will be very close to 0.

If the action is completely balanced between ups and downs, the RSI indicator will show The Relative Strength Index definition is as a momentum oscillator.

Relative Strength Index (RSI)

It shows whether the bulls or bears are winning over the look-back period, which can be adjusted by the user. The third and fourth methods described above regarding the cross of the 50 level, are generally superior to the first and second methods concerning 30 and That is because better long-term profits can be made in Forex by following trends than by expecting prices to always bounce back to where they were: The best way to trade crosses of the 50 level is by using the indicator on multiple time frames of the same currency pair.

Open multiple charts of the same currency pair on several time frames: Open the RSI indicator on all the charts and make sure the 50 level is marked. Practically all charting programs or software includes the RSI so it should not be difficult. A good look back period to use in this indicator is It is also important that the look back period is the same on all the different time frame charts.

If you can find a currency pair where all the higher time frames are either above or below 50, and the lower time frame is the other side of 50, then you can wait for the lower time frame to cross back over the 50 and open a trade in the direction of the long-term trend.

The higher or lower the RSI value is, the better the trade is likely to be.

It is an iron law of the markets that strong trends are more likely than not to keep going, and that a retracement that then turns back around tends to move nicely in the direction of the trend. This method is an intelligent way to use an indicator: It is below 50 on the weekly, daily, and 4 hour time frames, and is just crossing from above 50 to below 50 on the 5 minute time frame.

This could be interpreted as a signal for a short trade. There is no reason why this cannot be combined with other strategies such as support and resistance, moving average crossovers, time of day etc. It can also be used as a day trading strategy when you are prepared to drop down to low enough time frames.

A Better Way to Use RSI to Signal When to Take a Forex Trade

Best results are obtained when there is no big gap between the time frames that are used. Adam is a Forex trader who has worked within financial markets for over 12 years, including 6 years with Merrill Lynch.

He is certified in Fund Management and Investment Management by the U.

Learn more from Adam in his free lessons at FX Academy. Registration is required to ensure the security of our users.

Login via Facebook to share your comment with your friends, or register for DailyForex to post comments quickly and safely whenever you have something to say. Log in Create a DailyForex. Want to get in-depth lessons and instructional videos from Forex trading experts? Register for free at FX Academy, the first online interactive trading academy that offers courses on Technical Analysis, Trading Basics, Risk Management and more prepared exclusively by professional Forex traders. DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and Forex broker reviews.

The data contained in this website is not necessarily real-time nor accurate, and analyses are the opinions of the author and do not represent the recommendations of DailyForex or its employees.

Currency trading on margin involves high risk, and is not suitable for all investors. As a leveraged product losses are able to exceed initial deposits and capital is at risk. Before deciding to trade Forex or any other financial instrument you should carefully consider your investment objectives, level of experience, and risk appetite.

We work hard to offer you valuable information about all of the brokers that we review. In order to provide you with this free service we receive advertising fees from brokers, including some of those listed within our rankings and on this page.

While we do our utmost to ensure that all our data is up-to-date, we encourage you to verify our information with the broker directly. Forex Reviews Forex Brokers Reviews Bitcoin Forex Brokers ECN Forex Brokers US Forex Brokers UK Forex Brokers Canadian Forex Brokers Australian Forex Brokers Singapore Forex Brokers South Africa Forex Brokers Islamic Forex Brokers Regulated Forex Brokers MT4 Forex Brokers Mobile Trading Brokers Social Trading Platforms. Oil Trading Brokers Gold Trading Brokers NFA Regulated Brokers Automated Forex Trading More In Reviews Forex Brokers By Type Forex Signals Reviews Forex Products Reviews Forex Courses Reviews Forex Brokers Bonuses Binary Options Brokers Full Brokers List.

Forex News Technical Analysis Fundamental Analysis Trading Mind Blog Forex Blog Financial Humor Forex Expo Forex Newsletter More Technical Analysis Weekly Forex Forecast Free Forex Signals Gold Price Forecast. Analysis By Pair EUR-USD USD-JPY GBP-USD USD-CHF USD-CAD AUD-USD Bitcoin-USD Gold Oil. How To Choose a Broker Guide Learn Forex at FXAcademy Forex Articles Binary Options Trading Forex Social Trading Guide Forex Glossary Forex Basics Forex Webinars Forex Regulations.

DailyForex Mobile App Need Help Choosing a Broker? Report Broker Scams Forex Widgets Sitemaps. Forex Articles Momentum Trading Strategies RSI: King of Indicators RSI: What is the RSI Relative Strength Index? Relative Strength Index Technical Analysis The RSI indicator is typically used in forecasting and trading strategies in the following ways: When the RSI is over 70, it should be expected to fall. A fall below 70 from above 70 is taken as confirmation that the price is beginning a move down.

When the RSI is under 30, it should be expected to rise. A rise above 30 from below 30 is taken as confirmation that the price is beginning a move up.

How do I use the Relative Strength Index (RSI) to create a forex trading strategy? | Investopedia

When the RSI crosses above 50 from below 50, it is taken as a signal that the price is beginning a move up. When the RSI crossed below 50 from above 50, it is taken as a signal that the price is beginning a move down.

What is the Best Way to Use the RSI? Multiple Time Frame Cross of the 50 Level Open multiple charts of the same currency pair on several time frames: Adam Lemon Adam is a Forex trader who has worked within financial markets for over 12 years, including 6 years with Merrill Lynch.

Sign Up Read Review. Free Forex Trading Courses Want to get in-depth lessons and instructional videos from Forex trading experts? Sign up to get the latest market updates and free signals directly to your inbox. Most Visited Forex Broker Reviews. About Us Contact Us. Enter your email address here: