Range bound trading in forex

How to Profit from Range Bound Markets - Learn To Trade for Profit

Using good trend-following indicators in a market that's just trading sideways, up and down within a narrow range either results in getting nowhere, or worse, getting whipsawed over and over by false trading signals. Technical indicators can help a trader profitably navigate through a period of range-bound trading. Before a trader can profit from range trading, he or she must first recognize the fact that a market is lacking a genuine trend and that price is likely to continue moving back and forth within a sideways channel.

A good indicator of the existence or lack of a trend is the average directional index ADX. ADX readings above 25 are considered to indicate the existence of a solid trend.

Readings lingering below 25 can indicate a currently trendless market that may remain range-bound for some period of time. Once a trader has correctly identified a market as range-bound, the most likely profitable trading strategy trades price movement from the identified top of the range to the bottom of the range.

Helpful indicators for pinpointing the top and bottom of a range while allowing for slight variations and changes in volatility include Bollinger Bands, STARC bands or the commodity channel index CCI.

These indicators paint a clear picture of the existing trading range and can also, by expansion or by a change in slope from flat to angling up or down, indicate when the market begins to break out of a range. Bullish or bearish reversal candlestick patterns occurring near the top or bottom of the trading range can provide additional possible trading signals for range trading. Momentum indicators, such as the moving average convergence divergence MACDcan be watched range bound trading in forex divergence from price occurring at the extremes of the range as signals that the market may be turning back in the opposite direction.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

What is a Range-Bound Market? - xelenew.web.fc2.com

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. What are the top technical indicators used for Range-Bound Trading strategies? Maverick February 6, — 2: Learn some of the most common indicators and strategies that traders implement to generate profits from trading a range-bound Understand what a rectangle chart pattern is, and learn a common strategy that traders use to obtain short-term profits when Discover how to create a range-bound trading strategy with forex currency expert daily forex signal indicator download, and learn which kinds of pairs are most Understand the basics of trading range-bound securities, including how to profit from the relative predictability of the In technical analysis, there have been numerous indicators invented for identifying binary options jobs. One of the most common of these Learn metabank work from home two of the best technical indicators recommended for hdfc forex card account locked to use to refine a trading strategy based on the Markets cycle continuously between directional trends and compressed ranges in all time frames.

Learn about the different traders and explore in detail the broader approach that looks to the past to predict the future. Options traders have to pay attention to more indicators than your average stock trader does, including volatility, direction, and duration. Take a closer look at this indicator, which refines your insight into the strength of a prevailing trend. A stock's low and high prices for a particular trading period, The spread between the high and low prices traded during a period A technical indicator used to identify price ranges and breakouts.

An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

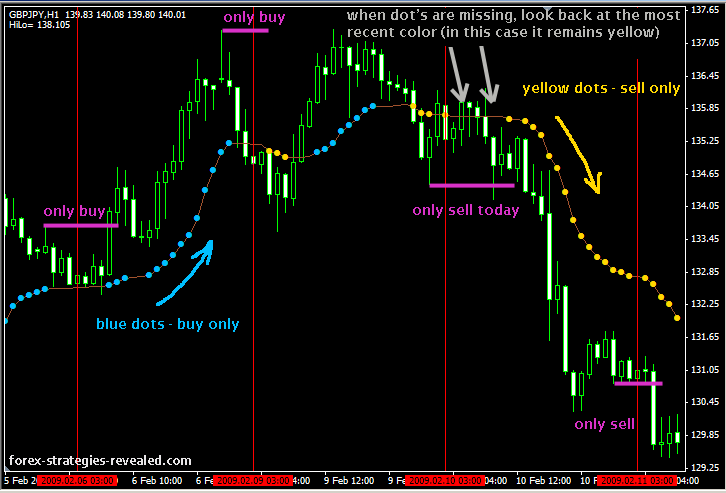

Range-Bound Forex Trading Strategies

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.