Option strategies for high implied volatility

Rolf Guest Post , Options Leave a comment 3, Views. If you are an experienced trader and want to share your expertise with our readers on Tradeciety.

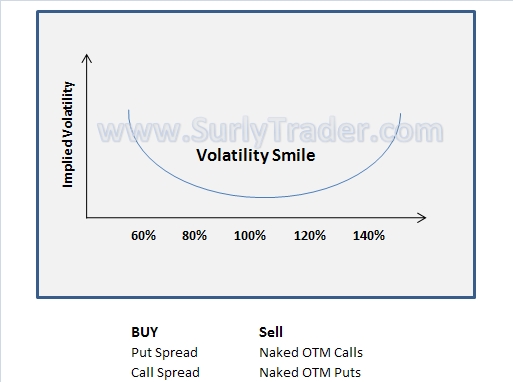

Volatility is the heart and soul of option trading. With the proper understanding of volatility and how it affects your options you can profit in any market condition. The markets and individual stocks are always adjusting from periods of low volatility to high volatility, so we need to understand how to time our option strategies. When we talk about volatility we are referring to implied volatility. Basically, it tells you how traders think the stock will move.

Implied volatility is always expressed as a percentage, non-directional and on an annual basis. Stocks listed on the Dow Jones are value-stocks so a lot of movement is not expected, thus, they have a lower implied volatility. Growth stocks or small caps found on the Russell , conversely, are expected to move around a lot so they carry a higher implied volatility.

The average price of the VIX is 20, so anything above that number we would register as high and anything below that number we register as low. When the VIX is above 20 we shift our focus into short options becoming net sellers of options, and we like to use a lot of short straddles and strangles, iron condors, and naked calls and put.

The trick with selling options in high volatility is that you want to wait for volatility to begin to drop before placing the trades.

If you can be patient and wait for volatility to come in these strategies will pay off. Short strangles and straddles involve selling a call and a put on the same underlying and expiration. The nice part about these strategies is that they are delta neutral or non-directional, so you are banking on the underlying staying within a range.

A Simple Spread Strategy for High Volatility -

If you are running a short strangle you are selling your call and put on different strikes, both out of the money. The strangle gives you a wider range of safety. This means your underlying can move around more while still delivering you the full profit.

The downside is that your profit will be limited and lower compared to a straddle and your risk will be unlimited. To gain a higher profit but smaller range of safety you want to trade a short straddle.

In this strategy you will sell your call and put on the same strike, usually at-the-money. Here you are really counting on the underlying to pin or finish at a certain price. Once you see volatility come in your position should be showing a profit so go ahead and close out and take your winnings. If you like the idea of the short strangle but not the idea that it carries with it unlimited risk then an iron condor is your strategy.

Iron condors are setup with two out of the money short vertical spreads, one on the call side and one on the put side.

Volatility Finder

The iron condor will give you a wide range to profit in if the underlying remains within your strikes and it will cap your losses. The iron condor is our go to strategy when we see high volatility start to come in.

The value in the options will come out quickly and leave you with a sizable profit in a short period of time.

Naked puts and calls will be the easiest strategy to implement but the losses will be unlimited if you are wrong. This strategy should only be run by the more experienced option traders. If you are bullish on the underlying while volatility is high you need to sell an out-of-the-money put option. This is a neutral to bullish strategy and will profit if the underlying rises or stays the same.

If you are bearish you need to sell an out-of-the-money call option. This is a neutral to bearish strategy and will profit if the underlying falls or stays the same. Both of these strategies should use out-of-the-money options. The further you go out-of-the-money the higher the probability of success but the lower the return will be. When you see volatility is high and starting to drop you need to switch your option strategy to selling options.

The high volatility will keep your option price elevated and it will quickly drop as volatility begins to drop. Our favorite strategy is the iron condor followed by short strangles and straddles.

Short calls and puts have their place and can be very effective but should only be run by more experienced option traders. Want to learn more about options? Your email address will not be published. Trading Resources Tradeciety Academy About us Contact Webmasters.

Tradeciety — Trading tips, technical analysis, free trading tools Forex Trading Blog And Trading Academy. Trading Blog Technical Analysis Market Analysis Indicators Price Action Psychology Beginners Risk Management Statistics Tips Premium Courses Member Login My Courses Member Forum Become A Member.

/about/volsmile-56ba2deb5f9b5829f840be29.png)

Contents in this article Short Strangles And Straddles Iron Condors Naked Puts And Calls Conclusion. Forex Trading Academy Forex price action course Private forum Weekly setups Apply Here.

High Implied VolatilityLeave a Reply Cancel reply Your email address will not be published. We are Rolf and Moritz. We have a passion for trading and sharing our knowledge. We travel the world and hope to inspire. We quit our corporate jobs a few years ago and are now living life the way we want it to be.

Our holy grail is hard work and independence. We have a passion for sharing our knowledge of the markets and hope to help other traders improve their trading. Tradeciety Trading Courses About Us Contact us Free Beginner Courses.

Trading Futures, Forex, CFDs and Stocks involves a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results. Articles and content on this website are for entertainment purposes only and do not constitute investment recommendations or advice. Full Terms Image Credit: Tradeciety used images and image licenses downloaded and obtained through Fotolia , Flaticon , Freepik and Unplash.

Trading charts have been obtained using Tradingview , Stockcharts and FXCM. Icon design by Icons8. Imprint Privacy Policy Risk Disclaimer Terms. Enter your email and get instant access.

Please share to spread the word Facebook Twitter Email. We use cookies to ensure that we give you the best experience on our website. The continuous use of this site shows your agreement.

Privacy Policy I accept.