How to calculate the intrinsic value of a stock option

Online Trading Academy has its roots in the largest trading floor in the Western US, founded in by Eyal Shahar. Independent traders needed training to be successful in their investments, and soon a teaching model was born. Enriching lives worldwide through exceptional financial education. There are some fascinating mathematics behind options.

One of those interesting properties of options is the way they relate stock prices, interest and dividends. If we know the prices for options on a stock, we can estimate from those prices what the next dividend payment is likely to be.

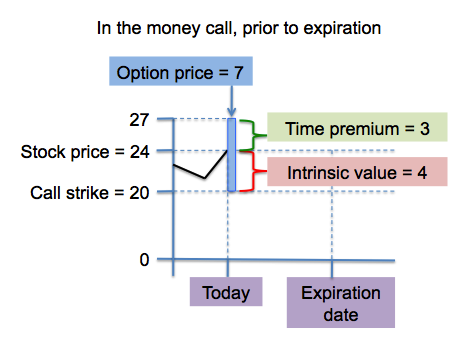

This is not due to any mystical power of options prices; it is just because the option market builds an estimate of dividends into the price of options, and they are usually pretty close in that estimate. If we know how, we can tease it out. If the option is in the money, it has intrinsic value equal to the amount by which it is in the money. If out of the money, it has no intrinsic value.

Here are some examples: In addition to its intrinsic value if it has any , an option may also have time value. Here is that table again, with option prices and time value added:. Notice that in this example, the Time Value for the Call option at each strike is equal to the time value for the Put option at the same strike. In a certain kind of world this relationship would always hold true. Where the stock is now is where it has the greatest probability of being at any date in the future.

The farther away from its current price the stock has to move to reach another strike, the less chance there is that it will happen and therefore the less time value. That is, as I said earlier, if we lived in a certain kind of world. That would be a world where interest rates were always zero and stocks never paid dividends.

If either non-zero interest or dividends do exist, then they are accounted for in the option prices. Think of it this way: This is not the most elegant formal description of interest in options, but it gives you the idea: Knowing the T-bill rate, the strike price, and the time to go, we can calculate how much interest could have been earned in that time.

Finally, we come to dividends. When a stock price drops for any reason , call prices go down and put prices go up. The total of the drop in the call and the increase in the put at the same strike adds up to the drop in the stock. And, with this piece of information we have a way to determine how much a dividend is likely to be. If an option has T days to go:.

Stock option expensing - Wikipedia

We can easily see what the time value is for both the put and call, and we can easily calculate the interest amount; so the expected dividends can be calculated. Here is a real-life example: SPY was scheduled to pay a dividend on December It had options in whose lifetime this would occur which were due to expire 30 days out, on December Now we have what we need to plug into our formula.

Check out our Professional Options Trader course and learn how to make options work for you! Celebrating 20 Years Transforming Lives for Two Decades Online Trading Academy has its roots in the largest trading floor in the Western US, founded in by Eyal Shahar.

Option Intrinsic Value Formulas - Macroption

Learn Programs Core Strategy Extended Learning Track Mastermind Community Specialty Courses Assets Stocks Forex Futures Options. Lessons from the Pros Calculators Financial Education Center Power Trading Radio Free Online Trading Courses. Our Company Instructors Reviews News Join Our Team. Subscribe to our award-winning Lessons from the Pros Newsletter. Home Resources Lessons from the Pros Using Option Prices Options December 22, Using Option Prices to Estimate Dividends Russ Allen Instructor.

Disclaimer This newsletter is written for educational purposes only. By no means do any of its contents recommend, advocate or urge the buying, selling or holding of any financial instrument whatsoever.

Trading and Investing involves high levels of risk. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader.

The author may or may not have positions in Financial Instruments discussed in this newsletter. Future results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future results. Reprints allowed for private reading only, for all else, please obtain permission. Network My OTA OTA Real Estate OTA Tax Pros.

Company Careers Franchising Reviews Staff. Legal Privacy Policy Risk Disclosure.

Support Contact Us Site Map.