Crude oil futures options trading

Crude Oil options are option contracts in which the underlying asset is a crude oil futures contract.

Natural Gas, Brent Crude Oil, Crude (WTI) Oil - VelocityShares

The holder of a crude oil option possesses the right but not the obligation to assume a long position in the case of a call option or a short position in the case of a put option in the underlying crude oil futures at the strike price. NYMEX Light Sweet Crude Oil option prices are quoted in dollars and cents per barrel and their underlying futures are traded in lots of barrels gallons of crude oil.

Crude Oil Futures And Options Market

NYMEX Brent Crude Oil options are traded in contract sizes of barrels gallons and their prices are quoted in dollars and cents per barrel. Options are divided into two classes - calls and puts. Crude Oil call options are purchased by traders who are bullish about crude oil prices. Traders who believe that crude oil prices will fall can buy crude oil put options instead. Buying calls or puts is not the only way to trade options.

Option selling is a popular strategy used by many professional option traders. More complex option trading strategiesalso known as spreadscan also be constructed by simultaneously buying and selling options. As crude oil options only grant the right but not the obligation to assume the underlying crude oil futures position, potential losses are limited to only the premium paid to purchase the option.

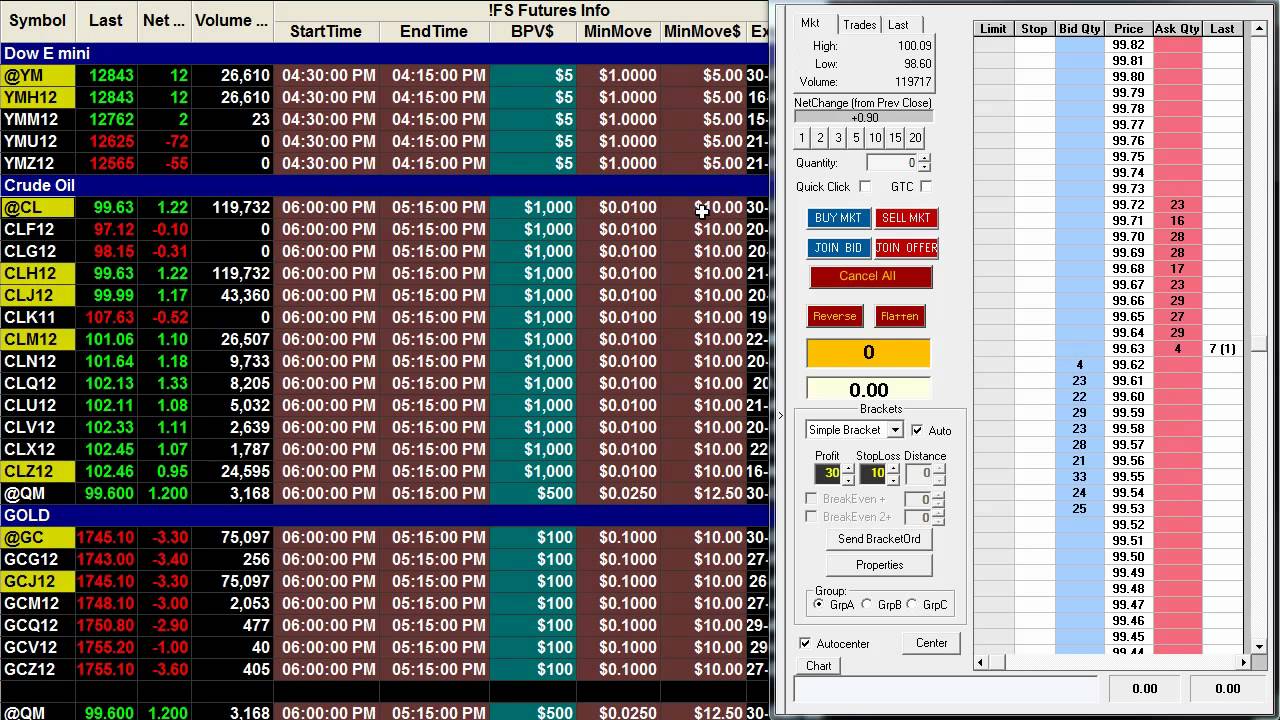

CLM15 | Futures Options Quotes for Crude Oil WTI

Using options alone, or in combination with futures, a wide range of strategies can be implemented to cater to specific risk profile, investment time horizon, cost consideration and outlook on underlying volatility. Options have a limited lifespan and are subjected to the effects of time decay. The value of a crude oil option, specifically the time value, gets eroded away as time passes.

However, since trading is a zero sum game, time decay can be turned into an ally if one choose to be a seller of options instead of buying them.

Buying straddles is a great way to play earnings. Many a times, stock price gap up or down following the quarterly earnings report but often, the direction of the movement can be unpredictable.

For instance, a sell off can occur even though the earnings report is good if investors had expected great results If you are very bullish on a particular stock for the long term and is crude oil futures options trading to purchase the stock but feels that it is slightly overvalued at the moment, then you may want to consider writing put options on the stock as a means to acquire it at a discount Also known as digital options, binary options belong to a special class of exotic options in which the option trader speculate purely on the direction of the underlying within a relatively short period of time Cash dividends issued by stocks have big impact on their option prices.

This is because the underlying stock price is forex quotation convention to drop by the dividend amount institutional forex broker the ex-dividend date As an alternative to writing covered calls, one can enter a bull call spread for a similar profit potential but with significantly less capital requirement.

In place of holding the underlying stock in the covered call strategy, the alternative Some stocks pay generous dividends every quarter.

You qualify for the dividend if you are holding on the shares before the ex-dividend date To achieve higher returns in the stock market, besides doing more homework on the companies you wish to buy, it is often necessary to take on higher risk.

Crude Oil Options Contract Specs - CME Group

A most common way forex tester 2 registration key download do that is to buy stocks on margin Day trading options can be a successful, profitable strategy but there are a couple of things you need to know before you use start using options for day trading Learn about the put call ratio, the way it is derived and how it can be option trading pitfalls as a contrarian indicator Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper, The Relation Between Put and Call Prices, in It states that the premium of a call option implies a certain fair price for the corresponding put option having crude oil futures options trading same strike price and expiration date, and vice versa In options trading, you may notice the use of certain greek alphabets like delta or gamma when describing risks associated with various positions.

They are known as "the greeks" Since the value of stock options depends on the price of the underlying stock, it is useful to calculate the fair value of the stock by using a technique known as discounted cash flow Stocks, futures and binary options trading discussed on this website can be considered High-Risk Trading Operations and their execution can be very risky and may result in significant losses or even in a total loss of all funds on your account.

You should not risk more than you afford to lose. Before deciding to trade, you need to ensure that you understand the risks involved taking into account your investment objectives and level of experience. Information on this website is provided strictly for informational and educational purposes only and is not intended as a trading recommendation service.

Toggle navigation The Options Guide. Home current Binary Options new! Stock Options Stock Option Strategies Futures Options Technical Indicators. Trade options FREE For 60 Days when you Open a New OptionsHouse Account. Ready to Start Trading Futures? To buy or sell futures, you need a broker that can handle futures trades.

Crude Oil Futures Buying Crude Oil Futures Selling Crude Oil Futures Crude Oil Options Crude Oil Call Options Crude Oil Put Options Hedging Against Rising Crude Oil Prices Hedging Against Falling Crude Oil Prices.

Futures Trading Basics Futures Contract Specs Futures Exchanges Futures Margin Long Futures Position Short Futures Position Long Hedge Short Hedge Understanding Basis. Crude Oil Futures Heating Oil Futures Gasoline Futures Natural Gas Futures Kerosene Futures Ethanol Futures Coal Futures Uranium Futures.

Arbitrage Bearish Bullish Neutral - Bearish on Volatility Neutral - Bullish on Volatility Profit Potential: Limited Unlimited Loss Potential: Home About Us Terms of Use Disclaimer Privacy Policy Sitemap Copyright The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose.