Adx indicator for binary options

Trading in the direction of a strong trend reduces risk and increases profit potential. The average directional index ADX is used to determine when price is trending strongly. In many cases, it is the ultimate trend indicator. After all, the trend may be your friend, but it sure helps to know who your friends are. In this article in this article, we'll examine the value of ADX as a trend strength indicator.

Introduction to ADX ADX is used to quantify trend strength. ADX calculations are based on a moving average of price range expansion over a given period of time. The default setting is 14 bars, although other time periods can be used. ADX can be used on any trading vehicle such as stocks, mutual funds, exchange-traded funds and futures.

For background reading, see Exploring Oscillators and Indicators: Average Directional Index and Discerning Movement With the Average Directional Index - ADX.

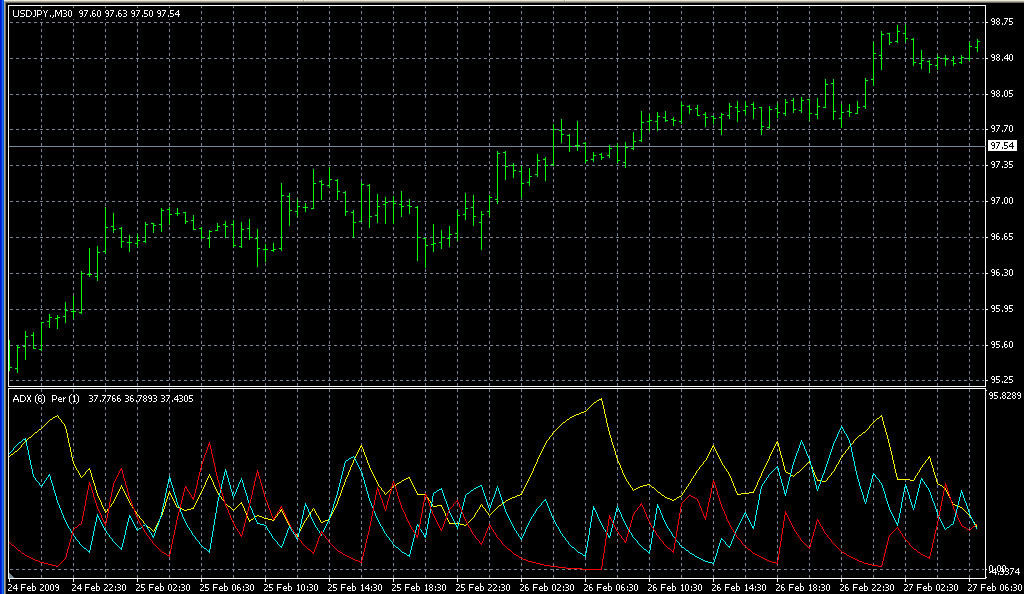

ADX is plotted as a single line with values ranging from a low of zero to a high of ADX is non-directional; it registers trend strength whether price is trending up or down. The indicator is usually plotted in the same window as the two directional movement indicator DMI lines, from which ADX is derived Figure 1.

For the remainder of this article, ADX will be shown separately on the charts for educational purposes. Figure 1 is an example of an uptrend reversing to a downtrend.

Quantifying Trend Strength ADX values help traders to identify the strongest and most profitable trends to trade. The values are also important for distinguishing between trending and non-trending conditions. Many traders will use ADX readings above 25 to suggest that the trend's strength is strong enough for trend trading strategies. Conversely, when ADX is below 25, many will avoid trend trading strategies. Low ADX is a usually a sign of accumulation or distribution. When ADX is below 25 for more than 30 bars, price enters range conditions and price patterns are often easier to identify.

Price then moves up and down between resistance and support to find selling and buying interest, respectively. From low ADX conditions, price will eventually break out into a trend. In Figure 3, price moves from a low ADX price channel to an uptrend with strong ADX.

The direction of the ADX line is important for reading trend strength.

When the ADX line is rising, trend strength is increasing and price moves in the direction of the trend. When the line is falling, trend strength is decreasing, and price enters a period of retracement or consolidation.

For more on this topic, check out Retracement Or Reversal: A common misperception is that a falling ADX line means the trend is reversing. A falling ADX line only means the trend strength is weakening, but it usually does not mean the trend is reversing unless there has been a price climax.

As long as ADX is above 25, it is best to think of a falling ADX line as simply less strong Figure 5. Trend Momentum The series of ADX peaks are also a visual representation of overall trend momentum.

ADX clearly indicates when the trend is gaining or losing momentum. Momentum is the velocity of price. A series of higher ADX peaks means trend momentum is increasing. A series of lower ADX peaks means trend momentum is decreasing. Any ADX peak above 25 is considered strong, even if it is a lower peak. In an uptrend, price can still rise on decreasing ADX momentum because overhead supply is eaten up as the trend progresses Figure 6.

Knowing when trend momentum is increasing gives the trader confidence to let profits run instead of exiting before the trend has ended.

However, a series of lower ADX peaks is a warning to watch price and manage risk. The best trading decisions are made on objective signals, not emotion.

ADX can also show momentum divergence. When price makes a higher high and ADX makes a lower high, there is negative divergence, or nonconfirmation. In general, divergence is not a signal for a reversal, but rather a warning that trend momentum is changing. It may be appropriate to tighten the stop-loss or take partial profits. For related reading, check out Divergences, Momentum And Rate Of Change. Divergence can lead to trend continuation, consolidation, correction or reversal Figure 7.

Strategic Use of ADX Price is the single most important signal on a chart. Read price first, and then read ADX in the context of what price is doing.

ACCURATE INDICATORS - stochastic + ADXWhen any indicator is used, it should add something that price alone cannot easily tell us. For example, the best trends rise out of periods of price range consolidation. Breakouts from a range occur when there is a disagreement between the buyers and sellers on price, which tips the balance of supply and demand.

Whether it is more supply than demand, or more demand than supply, it is the difference that creates price momentum. Breakouts are not hard to spot, but they often fail to progress or end up being a trap. But ADX tells you when breakouts are valid by showing when ADX is strong enough for price to trend after the breakout.

When ADX rises from below 25 to above 25, price is strong enough to continue in the direction of the breakout.

Conversely, it is often hard to see when price moves from trend to range conditions. ADX shows when the trend has weakened and is entering a period of range consolidation.

Range conditions exist when ADX drops from above 25 to below In a range, the trend is sideways and there is general price agreement between the buyers and sellers. ADX will meander sideways under 25 until the balance of supply and demand changes again.

For more see, Trading Trend Or Range? ADX gives great strategy signals when combined with price. First, use ADX to determine whether prices are trending or non-trending, and then choose the appropriate trading strategy for the condition. In trending conditions, entries are made on pullbacks and taken in the direction of the trend. In range conditions, trend trading strategies are not appropriate.

However, trades can be made on reversals at support long and resistance short. Finding Friendly Trends The best profits come from trading the strongest trends and avoiding range conditions.

ADX not only identifies trending conditions, it helps the trader find the strongest trends to trade. The ability to quantify trend strength is a major edge for traders. ADX also identifies range conditions, so a trader won't get stuck trying to trend trade in sideways price action.

In addition, it shows when price has broken out of a range with sufficient strength to use trend trading strategies. ADX also alerts the trader to changes in trend momentum, so risk management can be addressed. If you want the trend to be your friend, you'd better not let ADX become a stranger. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. The Trend Strength Indicator By Candy Schaap Share.

TDAmeritrade Strategy Desk Figure 1: ADX is nondirectional and quantifies trend strength by rising in both uptrends and downtrends. ADX Value Trend Strength Absent or Weak Trend Strong Trend Very Strong Trend Extremely Strong Trend Figure 2: ADX Values and Trend Strength Low ADX is a usually a sign of accumulation or distribution.

TDAmeritrade Strategy Desk Figure 3: When ADX is below 25, price enters a range. When ADX rises above 25, price tends to trend. TDAmeritrade Strategy Desk Figure 4: Periods of low ADX lead to price patterns.

This chart shows a cup and handle formation that starts an uptrend when ADX rises above TDAmeritrade Strategy Desk Figure 5: When ADX is below 25, the trend is weak. When ADX is above 25 and rising, the trend is strong. When ADX is above 25 and falling, the trend is less strong. TDAmeritrade Strategy Desk Figure 6: ADX peaks are above 25 but getting smaller. The trend is losing momentum but the uptrend remains intact.

TDAmeritrade Strategy Desk Figure 7: Price makes a higher high while ADX makes a lower high. In this case, the negative divergence lead to a trend reversal. Take a closer look at this indicator, which refines your insight into the strength of a prevailing trend. Learn how to use a number of different indicators to know when to make your trading moves.

The ADX shows trend direction as well as the strength of the trend.

5m ADX Stratgey - 5 Minute Strategies - Binary Options Edge

Right now, it's signaling strong trends in these four stocks. False signals can drown out underlying trends. Find out how to tone them down and tune them out. Stock prices seem random, but there are repeating cycles.

Learn to take advantage. Here are seven used most. Trading binary options is not for the novice, but if you're ready to delve in, get to know the best technical indicators.

Part 2: Technical Analysis - How To Use The ADX Indicator | x Binary Options

Markets cycle continuously between directional trends and compressed ranges in all time frames. In technical analysis, there have been numerous indicators invented for identifying trends. One of the most common of these Learn how the average directional index, or ADX, measures momentum and strength in market trends and how specific signals Learn about two of the best technical indicators recommended for traders to use to refine a trading strategy based on the Learn about average directional index, or ADX, indicators, including the calculations for various elements of the ADX technical Investors seeking new ideas may want to look to technical analysis to see whether the market has undervalued a particular Explore the uses of the volume price trend indicator VPT and learn the best technical indicators to use in conjunction An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other.

A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation.

How to use ADX Indicator to Trade Stock & Binary Options

A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.