Bull call spreads options

A bull call spread is an options strategy that involves purchasing call options at a specific strike price while also selling the same number of calls of the same asset and expiration date but at a higher strike. A bull call spread is used when a moderate rise in the price of the underlying asset is expected.

Credit spread (options) - Wikipedia

Bull call spreads are a type of vertical spread. A bull call spread may be referred to as a long call vertical spread.

Vertical spreads involve simultaneously purchasing and writing an equal number of options on the same underlying security, same options class and same expiration date.

Oscreener / Bull Put Spread Screener aka Credit Spread aka Vertical Spread options strategy screener

However, the strike prices are different. There are two types of vertical spreads, bull vertical spreads and bear vertical spreads, which could both be implemented using call and put options.

Bull Call Spread Explained | Online Option Trading Guide

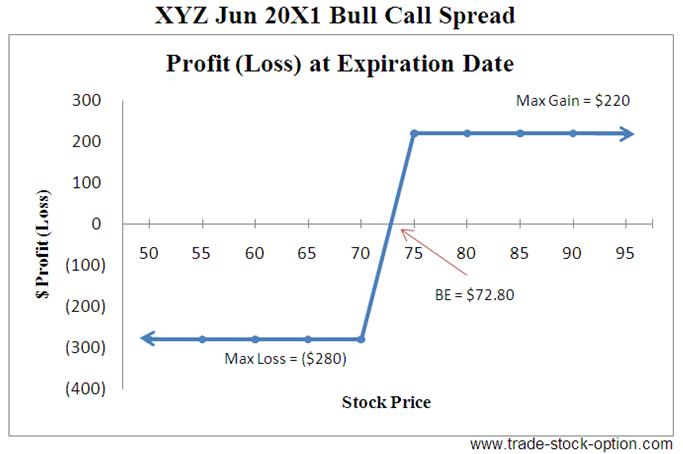

Since a bull call spread involves writing call options that have a higher strike price than that of the long call options, the trade typically requires a debit, or initial cash outlay. The maximum profit in this strategy is the difference between the strike prices of the long and forex investments best online trading profitsyoudeserve com options less the net cost of options.

The maximum loss is only limited to the net premium paid for the options. A bull estafados por finanzas forex spread's profit increases as the underlying security's price increases up to the strike price of the short call option. Thereafter, the profit remains stagnant if the underlying security's price increases past the short call's strike price.

Conversely, the position would have losses as the underlying security's price falls, but the losses remain stagnant if the underlying bull call spreads options price falls below the long call option's strike price.

Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Bull Call Spread Share.

Bear Call Spread Long Leg Bull Put Spread Bull Spread Diagonal Spread Horizontal Spread Call Ratio Backspread Short Leg Vertical Spread. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.